8 13 21 Ema Strategy

Which Moving Average Works Best For Intraday Trading In Stocks Quora

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Which Moving Average Works Best For Intraday Trading In Stocks Quora

Exponential Moving Average 5 Simple Trading Strategies Infographic

:max_bytes(150000):strip_icc()/dotdash_Final_The_Perfect_Moving_Averages_for_Day_Trading_Sep_2020-03-39f95b50cdd947d48a8b28ed34e2d8f0.jpg)

The Perfect Moving Averages For Day Trading

The Golden Ratio Multiplier Unlocking The Mathematically Organic By Philip Swift Positivecrypto Medium

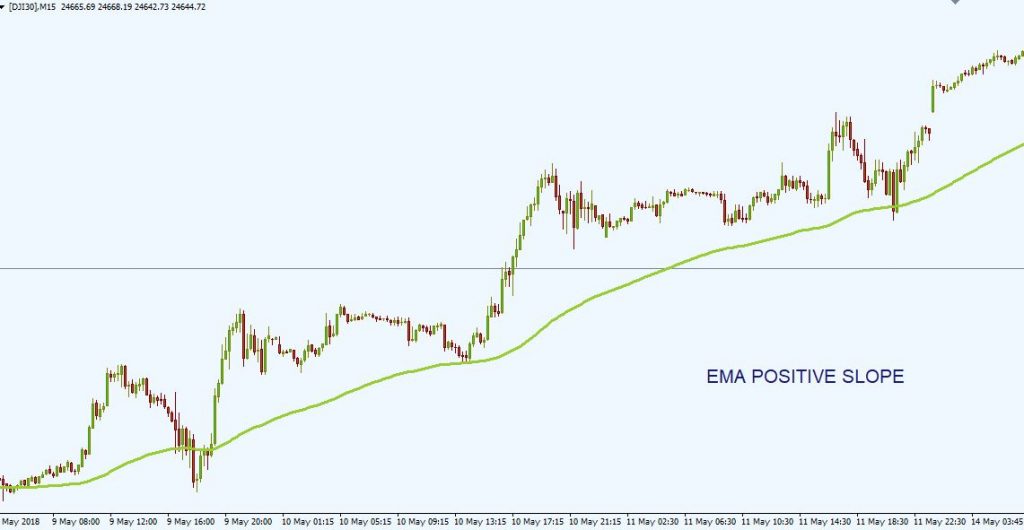

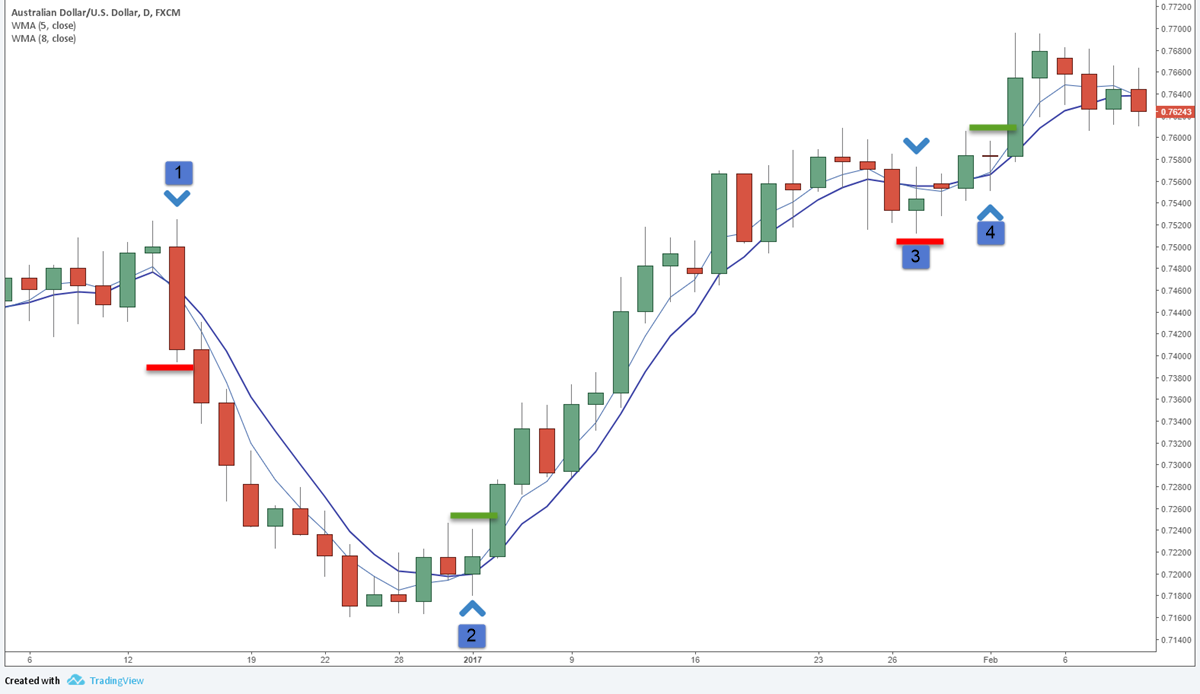

8 and 21, allowing to determine the trend and level of entry for transaction.

8 13 21 ema strategy. Hello, I haven’t tested it as this would give too many signals I believe, intraday is all about minute observation and deep knowledge of price action. Some of the most commonly used moving averages are the 10-day simple moving average (10 SMA), the SMA, the 50 SMA, and the 0 SMA, but there are many others (21 EMA, 34 EMA, 72 EMA, 100 SMA, to name a few. This includes stocks, indices, Forex, currencies, and the crypto-currencies market, like the virtual currency Bitcoin.

As you may have guessed, this strategy will be based on two exponential moving average (EMA):. It is not recommended for short-term investments. But, the crossover of the 7 EMA and 14 EMA shows promise for trade entry.

You don’t need to stick to the 5 and -period settings either because you may find that you get equally good results from using a 10 and -period EMA crossover. Analyzing the BUY trade on a 5-minute chart. Trade breakout with 5 EMA, 10 EMA, 14 EMA, 21 EMA, 50 EMA Whenever the 5, 10, 14, and 21 or 50 EMA’s form a narrow path on the chart they are in a range or in consolidation, i.e.

The formula for the exponential moving average is more complicated as the simple only considers the last number of closing prices across a specified range. Use Fibonacci Trendlines (8, 13, 21, 55) In a bull market, the 55 act as a support for everything (the price and the other. The price should 1.

The Exponential Moving Average EMA Strategy is a universal trading strategy that works in all markets. Place a buy order when the following chart rules or conditions are in display:. Hello All, I’m testing this method/system or whatever you want to call it.

If the exponential moving average strategy works on any type of market, they work for any time frame. The EMA’s overlap each other without going either up or down. Both of these moving averages are lagging indicators, so they have to be accepted with caution.

It would cause you to do more trades though. Any suggestions see attached sorry the moving average disappeared from the gif file. Watch for this setup on your own to get a better idea of how the strategy works, but keep in mind that no strategy works 100 percent of the time;.

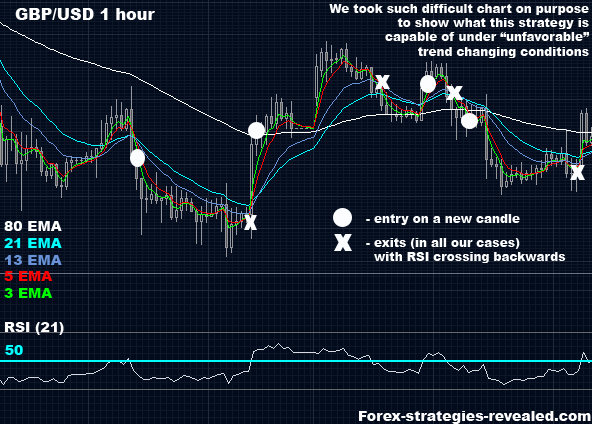

If the magenta upward pointing arrow of the EMA 5 10 34 Crossoverl.ex4 custom indicator is seen somewhat below the candlesticks as depicted on Fig. The 21 EMA is considered a medium term trend indicator:. 21 EMA with the 5M chart.

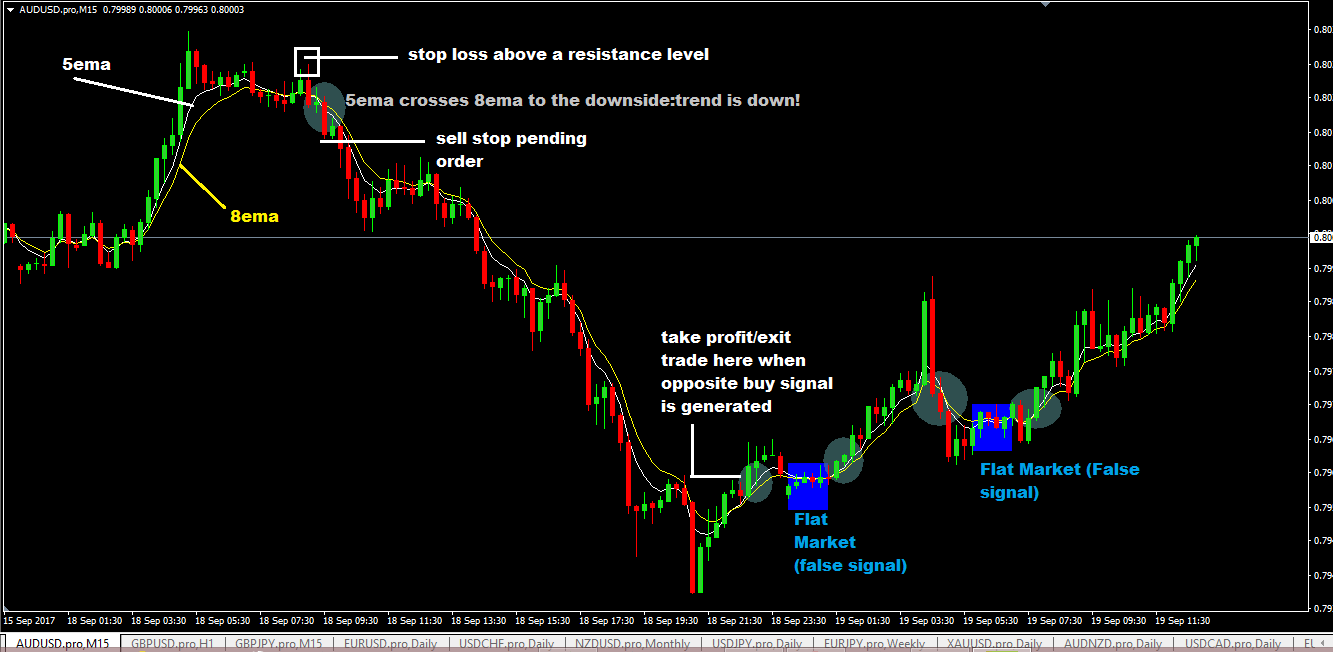

The trend is a downtrend when the 5 EMA crosses downward the 8 EMA. When there is confirmation, however, the 3- & 8- crossover is a. EMA 12 And EMA 26 trading strategy explained.

Satya strong steady safe scan - 26 (sssss-26) germinating seedlings - Germinating seedlings. You can use this forex strategy for any currency pairs. The 8 day moving average will be shown in magenta.

This strategy was based on two exponential moving averages (EMA):. Initiate a buy order if the following indicator or chart pattern gets displayed:. Wait for 5ema to cross 8ema to the upside.

European Medicines Agency (EMA), has published its draft of ‘Regulatory Science to 25’ strategy for a six-month public consultation, following the workshop organized last October.This “Reflection Paper” is a proposed plan for advancing the Agency’s engagement with regulatory science over the next five to ten years, covering both human and veterinary medicines. Simply put you only use one indicator/moving average. If i reduce the 55 and 21 it will slightly speed it up.

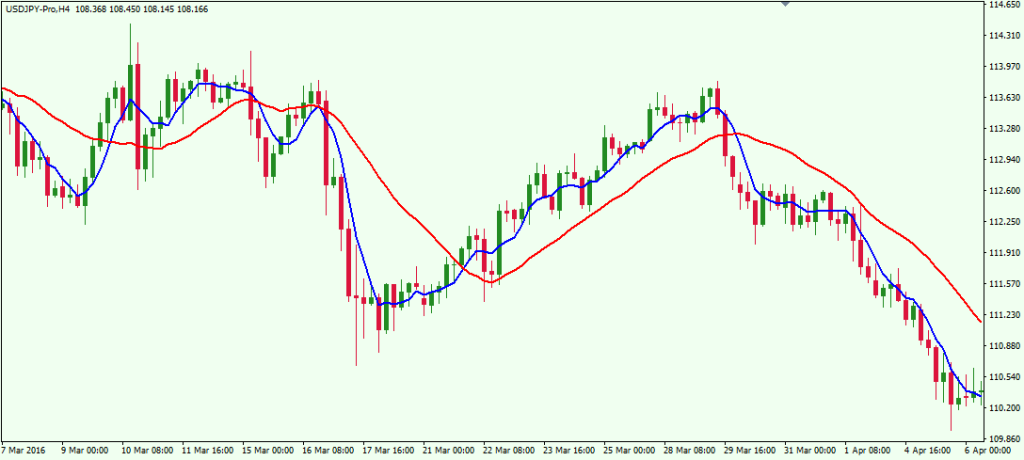

I just use the laws of nature:. This system uses a 4-hour and daily timeframe. The weight of the EMA is exponentially tilted towards more recent occurrences, giving the recent data greater influence over the reading.

Since I did not find the official name for this strategy, I thought that due to the indicators used I will call it EMA 8/. The difference in this strategy w.r.t the EMA crossover technique discussed earlier is that here there are 3 characters instead of two. This strategy is specific for a 3 hr, 4 hr, or a 6 hour chart.

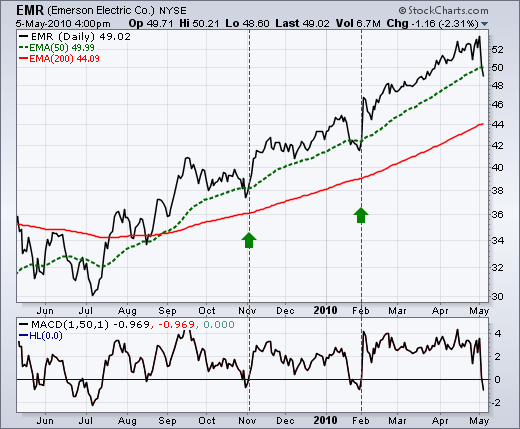

As you can see, once the EMA 13 crossed above the EMA 21, it confirmed the bullish trend, and as the bullish momentum accelerated, the distance between EMA 13 and EMA 21 widened. There are three moving averages on the 5-minute chart;. The price should be above the 13 EMA.

In figure 3, we have applied two Fibonacci sequence numbers, 13 and 21, as two Exponential Moving Averages (EMAs) on the chart. Keep in mind this is a short term swing trading strategy so keep your profit expectations in check. This is super simple trading strategy and it takes effort before you are able to use it properly.

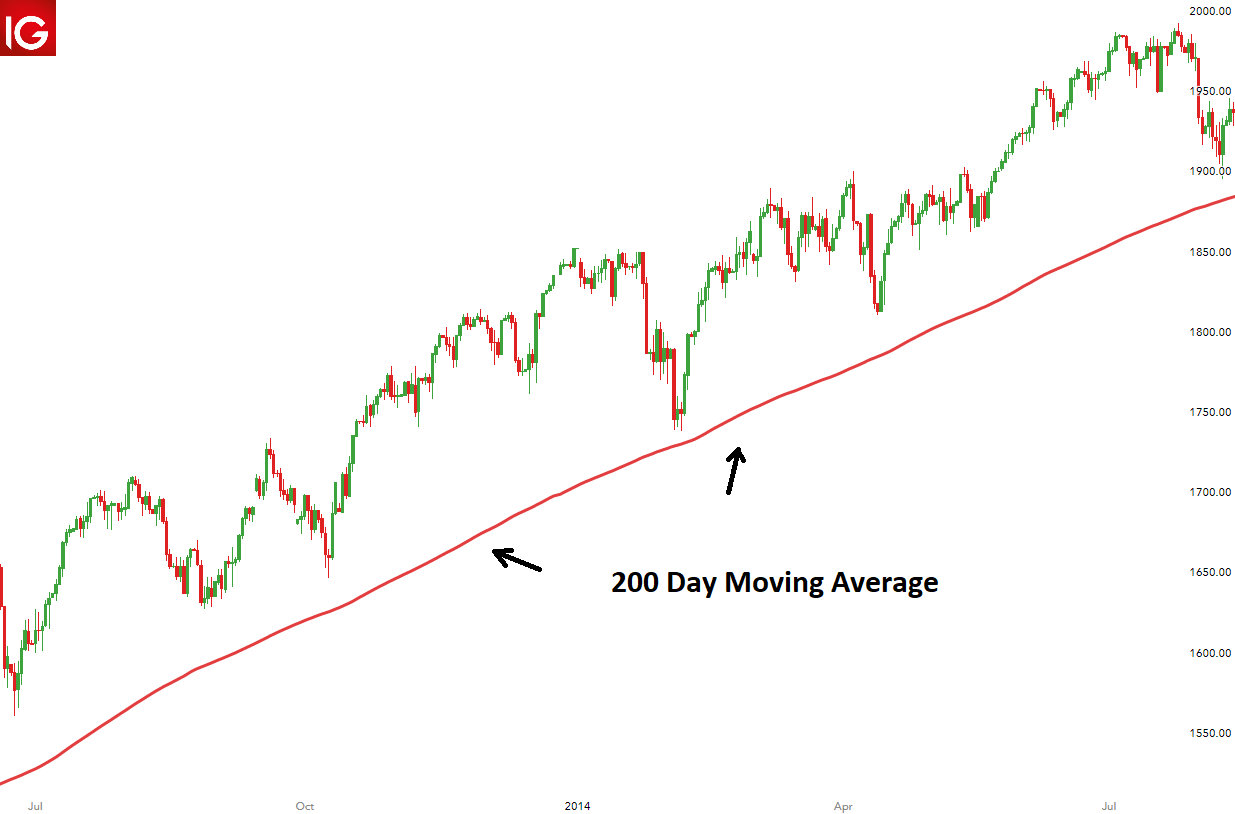

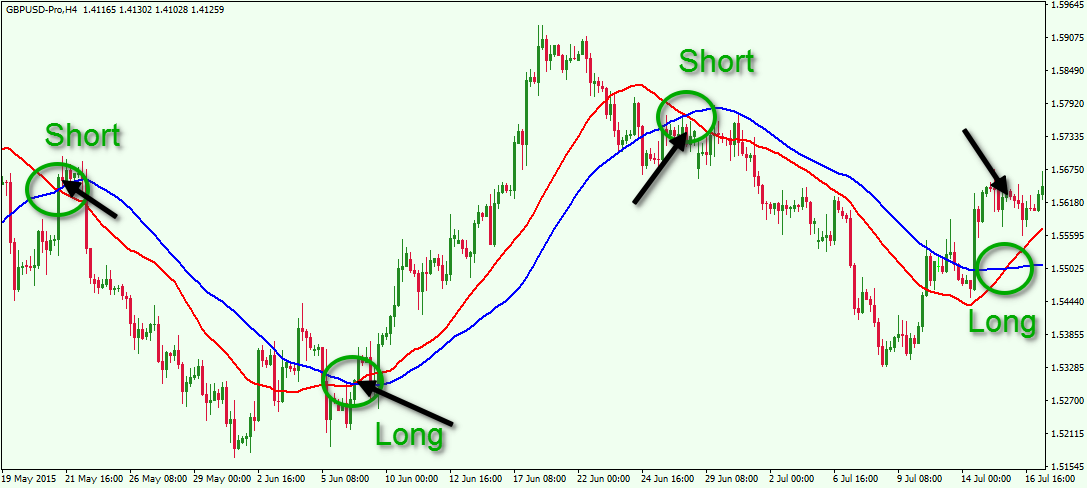

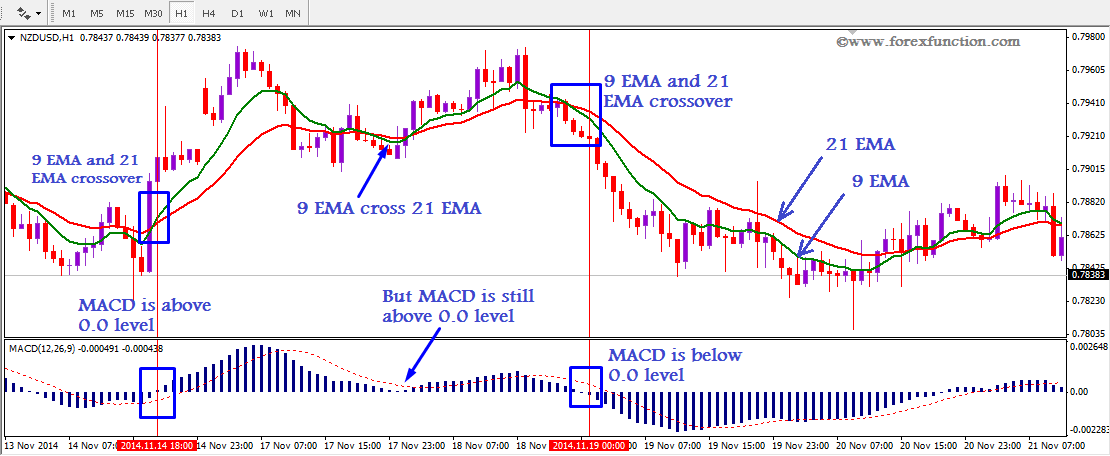

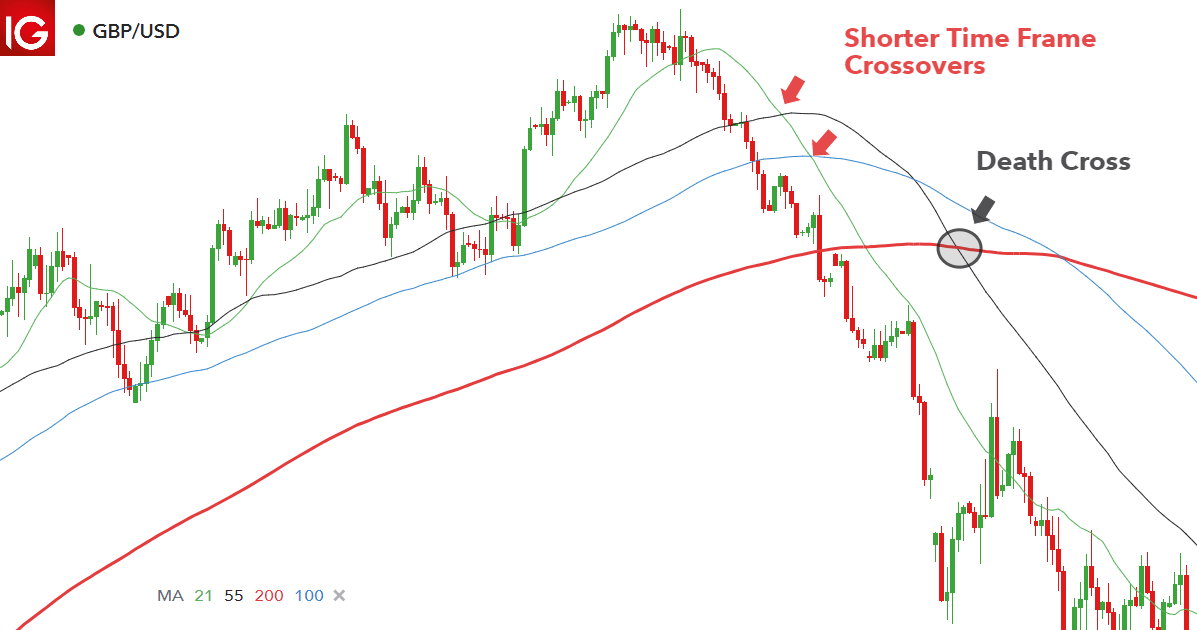

When 21 EMA downside breakout complete, then look at MACD indicator. This is confirmed by another crossover, the move of the 50-day MA below the 8-day EMA. EMA Crossover Trading Strategy A crossover between 2 moving average is probably one of the most well-known technical analysis signal used by traders.

The main thing is that you have a good understanding of how this short term trading strategy using two moving averages work. And the 21 day moving average will be in red. 3 EMAs will help identify and predict uptrends and downtrends -If EMAs are all above the candles it a sign to sell & if the EMAs are below its a sign to buy - If the Green-8 EMA crosses or touches red candle then flips under the other EMAs & candles then it's time to sell -If the Green-8 EMA crosses or touches green candle then flips above the other EMAs & candles then it's time to buy - how.

144 EMA (exponential moving average indicator). We have just defined half of our strategy - a complete rule to go long. I use a 150 EMA for trend.

September 19, 19 at 7:13 pm. Thank you for taking the time to write and share it. Since professional and institutional traders often use Fibonacci numbers moving average crosses, it ends up acting as a self-fulfilling prophecy as well.

First market price needs to cross 21 EMA from upper to lower. 1.0, price is said to pushed to the upside i.e. Over the past two weeks, I have published partly statistics showing the daily rates of return that could be derived from investing on this strategy.

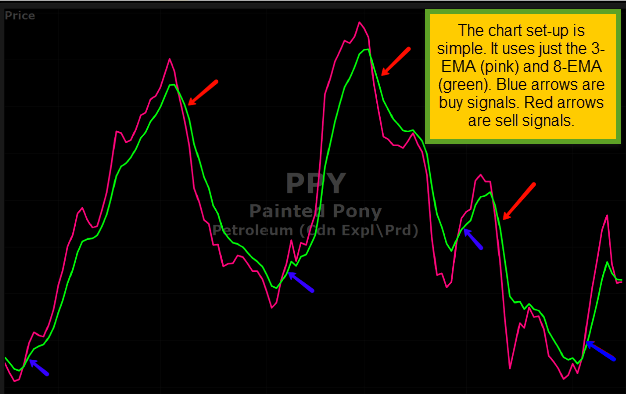

The general strategy is that when all the moving averages cross each other, it is time to go LONG with the 55 moving average staying BELOW. The 3-period and 8-period exponential moving average crossover is a variation of the traditional moving average crossover strategy. However, there are some subtle differences with this type of a trading strategy.

5 ema & 8 ema. This trading strategy is simple as using regular moving averages. I also use a MACD with settings 5, 50, 10.

At the same time, if MACD stay below 0.0 level, then open sell entry. The strategy is simple, we take 2 exponential moving averages, one with a shorter period and the other with a longer period and we track the signals when a crossover occurs. The exponential moving average (EMA) is a type of moving average that considers the weighted average of a series of recent data to reflect the ongoing trend in the market.

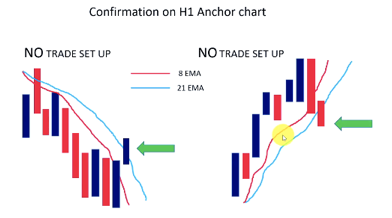

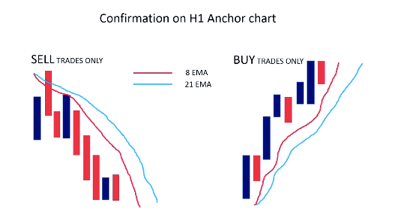

The point is that there are many ways that you can profit from the EMA crossover strategy, and the great thing is that you only really need to use two simple technical indicators. First place all the EMA on your chart then you will see three EMA just we need to check confirmation from H1 chart of trend direction. If the the 5 ema is below the 8 ema, we will look for short trades.

4.When the 3 EMA comes from below the 13 EMA to above. It, this is a signal to enter a long trade. Previously tested EMA Rainbow strategy was based on 3 moving average and its results were very satisfactory.

The 21 RSI With 5 EMA And 12 EMA Forex Trading Strategy is a very simple forex trading strategy that beginner forex traders as well as advanced forex traders can find useful. A trigger to buy the stipulated currency pair. An exponential moving average (EMA) is a type of moving average that places a greater weight and significance on the most recent data points.

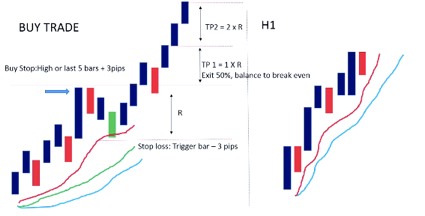

Orchid-consolidation - Consolidation using ema(5,13,26) Good stocks for jeevan - Observe price crossing above ema or sma for the last 8/9 days. You need the 5 and & 8 exponential moving averages. Say, we have confirmed a BUY trade on the H1 chart, and have a nicely laid out 5-minute chart.

Open the position when EMA5 has crossed EMA13. Wait for 5 ema to cross 8 ema to the upside. As price moves on, we look out for a trigger.

You can get efficient results using at least 4 hours chart. Need help and suggestions. Trade entries are taken after the ema cross-over;.

5 EMA must cross the 8 EMA in an upward direction. 21 , 13 ,8 EMA. Not sure how to place take profits or SL’s.

Traders use many different moving averages as support and resistance. Now we can repeat the whole process also for the Go short rule, but there is an easier way. As you can see, in the far left, when the green line moved above the red line, the price soon gained bullish momentum and started to move up.

If the 5 EMA (red) crosses the 8 EMA (blue) and the 13 EMA (magenta) upwards and they tend to form an intersection, it indicates that price is about to take an upward spin. 13 EMA (exponential moving average indicator);. Buy at the close of the candlestick that closes after the ema’s have crossed.

For trade exit the reverse crossover of those EMA's occasionally causes you to lose many of the pips of profit when the reversal/pullback is at a shallow angle. This is applicable to any currency pairs. While you can use any moving average, be it the combination of 5 and 10, or 15 and 30, the best crosses are always based on the Fibonacci sequences such as 5, 8, 13, 21… etc.

There is nothing easy about trading but that does not mean you can’t have a simple trading strategy for Forex, Futures, Stocks, or any market and one that works if you follow the rules. 5, 8, and 13 period simple moving averages offer perfect inputs for day traders seeking an edge in trading the market from both the long and short sides. The Long rule will be activated when EMA(10) crosses above EMA() and will close the (potential) Short order and open a new Long order.

Defining the trading rule to go Short. Your use is at your own risk. The price should be above the 3 EMA.

5 EMA And 8 EMA Trading Strategy Details. An exponential moving average gives recent prices a bigger weight, so it does a better job of measuring recent momentum. The EMA 12 and EMA 26 trading strategy combines two different exponential moving averages.

The epiphany came when I started using the 3 EMA and 8 EMA crossover points as indicators to trade into and out of positions with the Vector Vest program. My EMA cross however comes about 5 candles and 25 pips too late. The 8 EMA, the 13 EMA, and the 21 EMA.

The 5 EMA and 8 EMA trading strategy can be applied to any market of your choice. It is not an investment recommendation. In Figure 1, we have applied a green colored 13 period EMA and a red colored 21 period EMA on the 5-minute chart of Ford Motor Company (NYSE:F).

I take from Fibonacci sequence numbers 5 and 13 as the parameters for moving averages.When you wish to determine the price movement, the time for opening and closing the positions, use Exponential Moving Average (Exponential moving average) 5 and 13 indicators and follow these rules:1. Read on to learn more about this innovative strategy. 50 days ema/sma below 0 days ema/sma;.

At the conclusion of this chart, the 8-day EMA is below price, predicting a likely retracement to the downside. This confirms a likely bearish move to occur next. The principle of this strategy is when the 5 EMA will cross upward the 8 EMA, then the direction of the trend is an uptrend.

With this forex trading strategy, you don’t need to do a lot of technical analysis because it would probably take just a 5 seconds scan of your forex charts to see if you can trade or not, that’s how simple it is. However it will be more volatile to false signals i assume, so is there anything better i can use to show changes in trend. If need be, you could also make use of this trading strategy on intraday chart time frame as well.

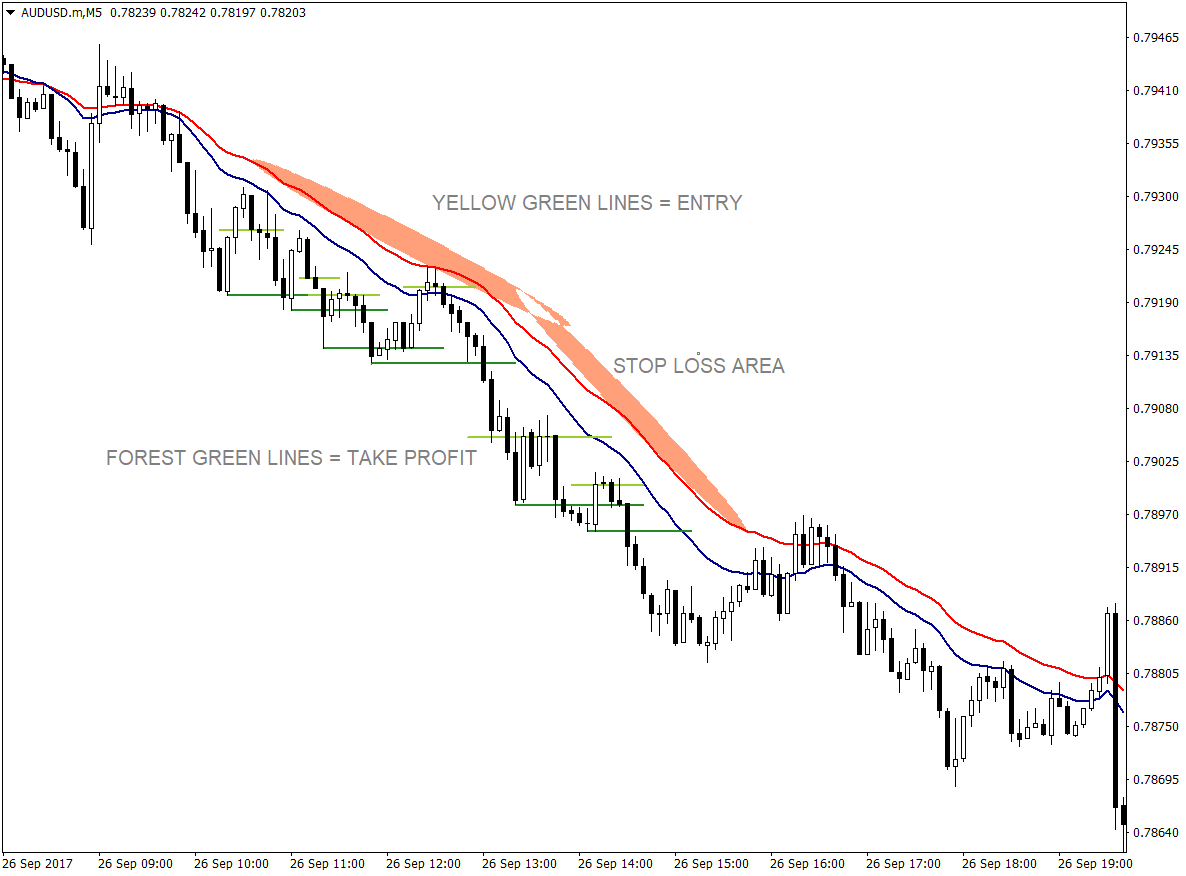

Ema sell - Ema buy - Buy day ema - Ha ema co bullish - Ha ema co bullish;. Then on M5 in same direction we need pending stop orders in the trend direction of H1. Timing is the key, at times then we select a candle of less time period with so many average lin.

You might try a close below the 7 EMA as an exit strategy. These averages work the same as a traditional SMA. Be above the 144 EMA.

More Moving Average (MA) Definition. Time frame M5 and H1. Buy/sell when the candle closes above/below the moving average.

I use exponential moving averages of 8, 13, 21, and 55. Set SL above moving average or set manually 15-25 pips. Going forward in this article, we will only use exponential moving averages.

I use a 55 and 21 EMA, and when they cross i buy/sell. Strategy #1 – Real-Life Example going with the primary trend using the SMA. Square off when it cuts EMA 8.

Above, you can see the daily chart set up that I use for the 3-EMA and the 8-EMA crossovers. In one graph, 4 different periods include EMA (8/13/21/55). Now in action what we have to do.

We want to see the 21 below the 9 and above the 55 for an uptrend The 21 should be above the 9 and below the 55 for a down trend. The EMA trading strategy discussed below will revolve around the use of a series of EMA’s (Exponential Moving Average).

Golden Cross Trading 5 Best Golden Cross Strategies Trading In Depth

Moving Average Sma Ema Oldest Trick Or The Golden Ticket Frxe

The Moving Average Indicator Guide How It Improves Your Trading Strategy And Helps You Beat The Markets

The Ultimate Guide To Moving Averages Trend Analysis The Pro S Way T3 Live

Perutrading Indicators And Signals Tradingview

Stockdweebs My Million Dollar Strategy Indicators 1 13 21 55 Ema 2 0 Ma 3 When 0 Ma Crosses Under 12 21 55 Ema Bullish Trade Setup 1 Only Uptrend

Moving Averages Varsity By Zerodha

How To Trade With The Exponential Moving Average Strategy

Guide To Trading Using The Ema Indicator On Iq Option Iq Option Wiki

Moving Averages Part 2 Financial Markets Economies

The Best Back Tested Trading Strategies With Moving Averages New Trader U

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Q Tbn 3aand9gcsjpexkqngnq Qcokhsfskpj36abcmrxwswuebp0 Mmy Kantlw Usqp Cau

How To Use Best Moving Averages Forex Trading Strategies Youtube

5 8 13 Forex Scalping Trading Strategy

3

:max_bytes(150000):strip_icc()/professional-profession-chart-font-diagram-multimedia-1163690-pxhere.com1-f9ca2bfa361044e9a3d6292b691e3835.jpg)

Most Commonly Used Periods In Creating Moving Average Ma Lines

Anatomy Of Popular Moving Averages In Forex Forex Training Group

8 Ema 5 Ema Trading Strategy

Exponential Moving Average Definition Day Trading Terminology Warrior Trading

Secrets Of Trend Analysis The Power Of The 8 21 Day Moving Averages T3 Live

0 Day Moving Average What It Is And How It Works

The Ultimate Guide To Moving Averages Trend Analysis The Pro S Way T3 Live

Complex Trading System 4 Trend Trading With Emas Forex Strategies Systems Revealed

Moving Average Strategy Guide 5 Moving Average Strategies

Philakone Ema 8 13 21 55

Page 5 Multiples Indicators And Signals Tradingview India

5ema And 8ema Forex Trading Strategy Ema Forex Strategy

Etoro S Guide To Technical Analysis Tools Trader S Lingo

Managing Positions Using 3 Ema 8 Ema Crossovers Vectorvest Canada Blog

The Moving Average Indicator Guide How It Improves Your Trading Strategy And Helps You Beat The Markets

6 Killer Combinations For Trading Strategies Fx Leaders

:max_bytes(150000):strip_icc()/dotdash_Final_The_Perfect_Moving_Averages_for_Day_Trading_Sep_2020-02-b64a1ea406794bb38847ecbdd5b6e2e2.jpg)

The Perfect Moving Averages For Day Trading

Ema Strategy 8 13 21 By Viniciuszampirolicerqueira Tradingview India

The Moving Average Indicator Guide How It Improves Your Trading Strategy And Helps You Beat The Markets

Ema Blue Green Yellow Red Strategy Indicator By Heffjobbs9 Tradingview

21 Rsi With 5ema And 12 Ema Forex Trading Strategy

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

21 And 34 Exponential Moving Average Bounce Forex Trading Strategy Forex Mt4 Indicators

/dotdash_Final_Strategies_Applications_Behind_The_50_Day_EMA_INTC_AAPL_Jul_2020-01-0c5fd4e9cb8b49ec9f48cb37d116adfd.jpg)

Strategies Applications Behind The 50 Day Ema Intc pl

How To Use Moving Averages Moving Average Trading 101

Moving Average Strategy Guide 5 Moving Average Strategies

Exponential Moving Average 5 Simple Trading Strategies Infographic

5 Ema And 13 Ema Fibonacci Numbers Trading System Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast

The Moving Average Indicator Guide How It Improves Your Trading Strategy And Helps You Beat The Markets

Golden Cross Trading 5 Best Golden Cross Strategies Trading In Depth

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Macd Scalping Strategy Free Forex Trading Systems Babypips Com Forex Trading Forum

Moving Average Strategy Guide 5 Moving Average Strategies

Http Simplerfutures S3 Amazonaws Com Files 3toolstotradelikea30yrmarketvet Full Pdf

5 Ema And 8 Ema Crossover Swing Trading System

How To Trade With The Exponential Moving Average Strategy

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

Moving Average Strategy Guide 5 Moving Average Strategies

Exponential Moving Average 5 Simple Trading Strategies Infographic

Simple Rsi Ema High Profitable Ratio Strategy Forex Factory

Which Moving Average Works Best For Intraday Trading In Stocks Quora

Ema Bounce Forex Trading Strategy

A 5 Step Scalping Strategy Forexsignals Com Blog

Anatomy Of Popular Moving Averages In Forex Forex Training Group

Golden Cross Trading 5 Best Golden Cross Strategies Trading In Depth

Multiple Ema 8 13 21 55 By Melihguler Indicador Por Melihguler Tradingview

325 Million New Users Bitcoin Today June 24th By Try Can Do Medium

3

Moving Average Strategy Guide 5 Moving Average Strategies

Gold Ema Alignment Strategy Fx Vix Traders Blog

5 Ema And 13 Ema Fibonacci Numbers Trading System Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast

Ema Strategy 8 13 21

A Simple Strategy You Can Use To Finally Start Making Great Money Forextradersdaily

Exponential Moving Average 5 Simple Trading Strategies Infographic

A 5 Step Scalping Strategy Forexsignals Com Blog

8 Indicateurs Et Signaux Tradingview

Moving Average Strategy Guide 5 Moving Average Strategies

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

5 8 13 Forex Scalping Trading Strategy

Q Tbn 3aand9gcse Xform4jvaq4ywgwqfz05 Wbr59 Ffqwzyuvp64lyjizs5mn Usqp Cau

The 21 Ema System Simple But It Works Trading Systems Babypips Com Forex Trading Forum

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

A Zero To A Million Trading Strategy Trading Strategy Guides

Tradingfibonacci Com Combining Fibonacci With Major Technical Analysis Tools

Moving Average Strategies For Forex Trading

5 8 13 Forex Scalping Trading Strategy Youtube

6 Killer Combinations For Trading Strategies Fx Leaders

Trading Strategy Of Ema Crossover With Macd

Exponential Moving Average 5 Simple Trading Strategies Infographic

0 Day Moving Average What It Is And How It Works

Secrets Of Trend Analysis The Power Of The 8 21 Day Moving Averages T3 Live

A 5 Step Scalping Strategy Forexsignals Com Blog

5 Ema And 13 Ema Fibonacci Numbers Trading System Forex Strategies Forex Resources Forex Trading Free Forex Trading Signals And Fx Forecast

How To Trade With The Exponential Moving Average Strategy

Moving Averages Simple And Exponential Chartschool

3ma Indicators And Signals Tradingview

Anatomy Of Popular Moving Averages In Forex Forex Training Group

Exponential Moving Average 5 Simple Trading Strategies Infographic

Ema Day Trading Exponential Moving Average Strategy The Secret Mindset

A Simple Strategy You Can Use To Finally Start Making Great Money Forextradersdaily

How To Trade With The Exponential Moving Average Strategy